There’s a Rogers Bank credit card that’s right for you

Rogers Bank credit cards reward the ways you already spend.

Your award-winning card for cash back

Top No Fee Cash Back Credit Card 20241

Rewards Canada

Best Challenger Credit Card 20242

Best Free Travel Credit Card 20244

Hardbacon

For the Rogers Red World Elite® Mastercard®

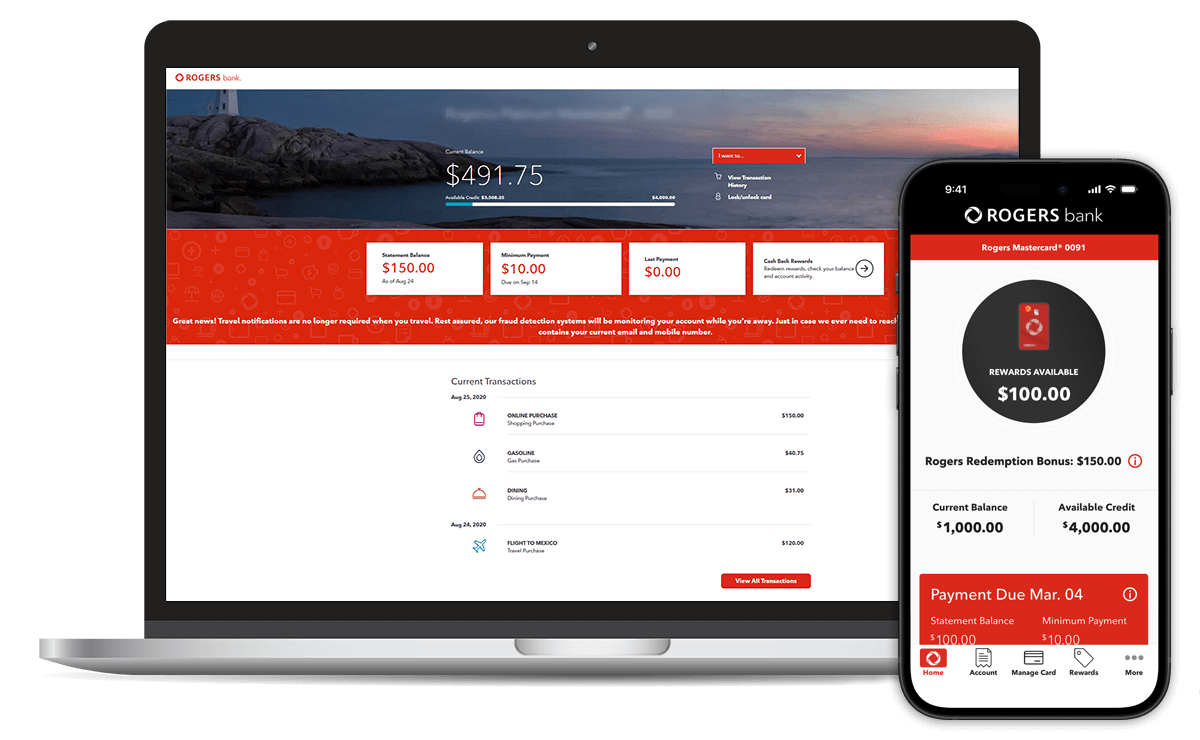

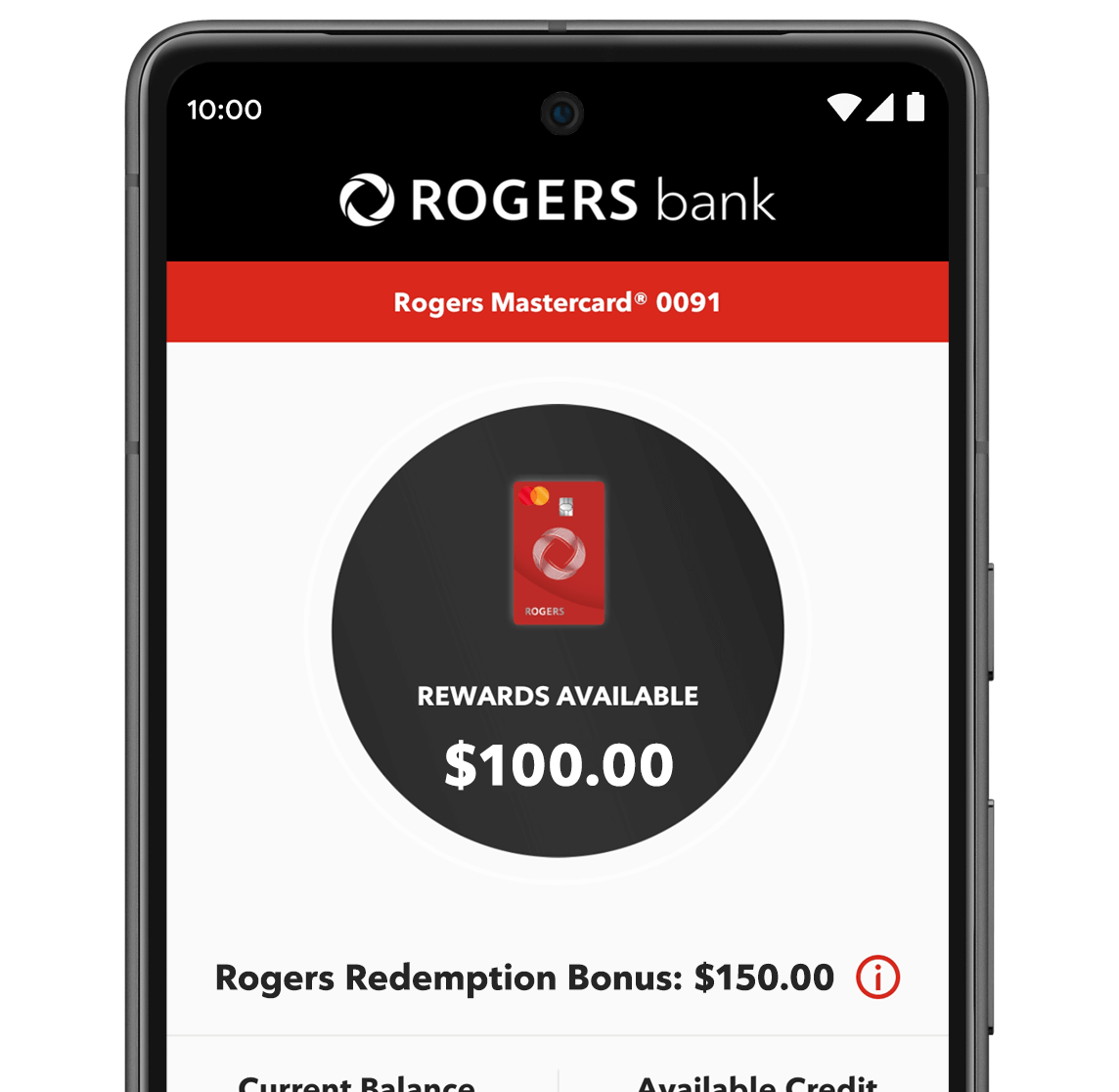

Manage your Rogers Mastercard anywhere

Simplified banking,

now available anywhere.

The Rogers Bank app is the easiest way to manage your account.

Rogers Bank AppMobile Wallet for Rogers Bank Mastercard is here!

Everything you love about your Rogers Bank credit card, now on your mobile device.

Mobile Wallet

With a Rogers Bank credit card, you get…

Rewards

without Limits

Get unlimited cash back rewards for all eligible purchases you make every day, and redeem them anywhere Mastercard is accepted.5

24/7

Security

Everything about your card is designed for maximum security, from automatic fraud prevention and personalized alerts to chip and PIN technology.

Balance Protection

Group Balance Protection Insurance6 protects you and your loved ones from the financial impact of unforeseen events.

Manage your Rogers Mastercard anywhere

Easy to earn, easy to redeem

Earn unlimited cash back rewards anywhere Mastercard is accepted, and redeem them for everyday purchases like gas and groceries, big ticket items, or apply them directly to your Rogers, Fido, or chatr bill.

Redeem your rewards instantly with the Rogers Bank app.

Card options for every customer

Learn more about Rogers Bank credit cards to find a card that’s right for you.

Get StartedOffers subject to change without notice. Application approval subject to credit assessment and income verification.

* As compared to financing a phone at full price with $0 down through a Financing Agreement with Rogers Communications Canada Inc. over 24 months without Upfront Edge and/or promo credits. Offer available to primary cardholders only on purchases of $250 or more made in a participating Rogers, Fido or Shaw-branded store using your Rogers Bank credit card. Terms of 36 or 48 months available. Offer must be accepted by the primary cardholder by submitting the request form with a Rogers representative at the time of purchase. Request cannot be made through your online Rogers Bank account or in any other manner. In order to qualify, at the time you submit your request: your account must be in good standing, you must have less than 6 Equal Payment Plans on your account and the outstanding balance on your account must be equal to or greater than the amount of the purchase. It may take up to 10 calendar days after submitting the request form for your purchase to be converted to an Equal Payment Plan. During the term of the Equal Payment Plan, interest will be calculated on the outstanding Equal Payment Plan balance at an annual interest rate of 0%. There is no interest payable from the date of the purchase up to the date the eligible purchase is converted to an Equal Payment Plan.

- As awarded by Rewards Canada in January 2024.

- As awarded by creditcardGenius in January 2024.

- As awarded by moneyGenius in January 2024.

- As awarded by Hardbacon in January 2024.

- Minimum purchase and redemption amount of $10. Cash back rewards apply up to lesser of purchase amount or rewards balance. Some exceptions apply, including cash advances and cash equivalents. Rewards are not refundable. Account must be in good standing. See Reward Program Terms and Conditions, rogersbank.com/legal.

- Rogers Bank optional Group Balance Protection group insurance is underwritten by Canadian Premier Life Insurance Company.

®/™Mastercard and World Elite are registered trademarks and the circles design is a trademark of Mastercard International Incorporated. Used under license.

™ Rogers and Mobius Design, Rogers Bank and related marks, logos and brand names are trademarks of Rogers Communications Inc., or an affiliate, used under license. © 2024 Rogers Bank.

The Rogers Mastercard is a credit card issued by Rogers Bank.

The Rogers Red World Elite Mastercard is a credit card issued by Rogers Bank.